Choosing the right trading platform for Forex is a critical decision for every trader. A reliable platform can significantly impact your trading performance and overall experience. In this article, we will explore various aspects that define a good Forex trading platform, while considering trading platform for forex tradingarea-ng.com as a comprehensive resource for traders.

Understanding Forex Trading Platforms

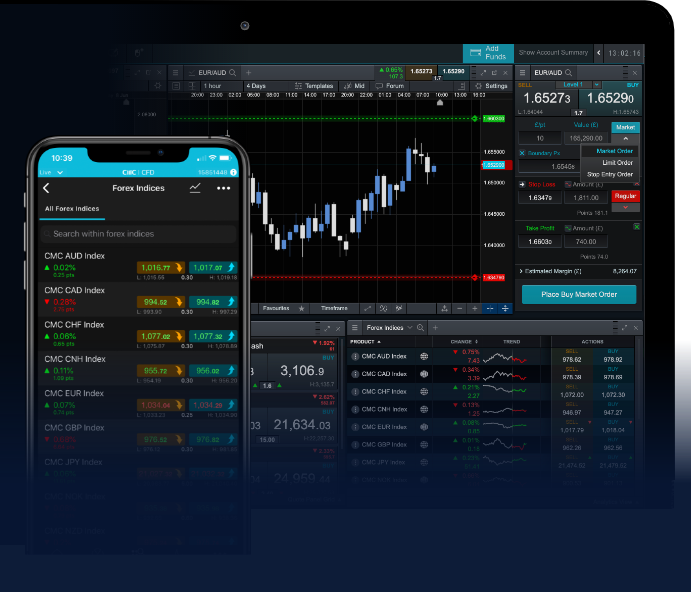

Forex trading platforms are software applications that allow you to buy and sell currencies in the foreign exchange market. They come with a variety of tools and features designed to facilitate trading and help traders make informed decisions. Choosing the right platform requires understanding your trading needs and evaluating the options available in the market.

Key Features of Forex Trading Platforms

When selecting a Forex trading platform, consider the following key features:

- User Interface: A user-friendly interface is crucial for efficient trading. Look for platforms that offer an intuitive layout and customizable options.

- Charting Tools: Effective charting tools are essential for technical analysis. A good platform provides a variety of indicators and overlays to help traders analyze price movements.

- Order Execution: Fast and reliable order execution can significantly affect your trading results. Ensure that the platform supports various order types and has minimal latency.

- Security: The safety of your funds and personal information is of utmost importance. Choose a regulated platform that utilizes high-level encryption to protect your data.

- Customer Support: Access to responsive customer support can enhance your overall trading experience. Look for platforms that offer multi-channel support, including live chat, email, and phone services.

- Mobile Trading: In today’s fast-paced world, mobile trading has become essential. A good trading platform should provide a mobile application to allow trading on the go.

The Significance of Regulation

Regulation plays a vital role in the Forex trading industry. A well-regulated Forex trading platform gives traders confidence that their funds and investments are secure. It ensures compliance with strict standards and guidelines set by financial authorities. Always verify the regulatory status of the platform before getting started.

Types of Forex Trading Platforms

Forex trading platforms can be categorized into three main types:

- Web-Based Platforms: These platforms are accessible through a web browser, providing flexibility for traders who do not want to download software.

- Downloadable Platforms: These require installation on your computer and often offer more advanced features and tools.

- Mobile Platforms: Designed for smartphones and tablets, mobile platforms ensure you can trade anytime, anywhere.

Evaluating Forex Trading Platforms

When evaluating Forex trading platforms, consider the following factors:

1. Costs and Fees

Understand the fee structure of the platform, including spreads, commissions, and any other costs associated with trading. A lower cost of trading can directly impact your profitability.

2. Available Currency Pairs

Different platforms offer varying numbers of currency pairs. Ensure that the platform you choose supports the currency pairs you wish to trade.

3. Research and Analysis Tools

Effective research and analysis tools can help you make informed trading decisions. Seek platforms that provide access to market news, economic calendars, and analytical tools.

4. Demo Account

A demo account is a valuable feature that allows you to practice trading in a risk-free environment. This is particularly beneficial for beginners looking to gain confidence before trading with real money.

Popular Forex Trading Platforms

There are several impressive Forex trading platforms available, each with unique features. Here are a few popular options:

- MetaTrader 4 (MT4): One of the most popular platforms worldwide, MT4 offers advanced charting tools, automated trading capabilities, and is user-friendly.

- MetaTrader 5 (MT5): The upgraded version of MT4, MT5 offers additional features such as more timeframes, additional order types, and improved analytical tools.

- cTrader: Known for its intuitive interface and advanced trading tools, cTrader is great for both novice and experienced traders.

- NinjaTrader: This platform offers powerful trading tools and is particularly favored for futures and Forex trading.

The Future of Forex Trading Platforms

The Forex trading landscape is continually evolving. Technological advancements, such as artificial intelligence (AI) and machine learning, are beginning to play a significant role in trading platforms. These technologies enable automated trading solutions, enhanced analytics, and personalized trading experiences. Furthermore, the rise of cryptocurrencies and blockchain technology introduces new opportunities for Forex traders, leading to the development of innovative trading platforms.

Conclusion

Choosing the right Forex trading platform is a crucial step in your trading journey. By considering the features, fees, and tools available, you can determine which platform aligns best with your trading style and goals. Always conduct thorough research, and if possible, test multiple platforms using demo accounts before committing. Remember, a well-chosen trading platform can help you optimize your trading performance and increase your chances of success in the dynamic world of Forex trading.