In the ever-evolving landscape of financial markets, online forex trading platforms have emerged as vital tools for both novice and experienced traders. With the ability to trade currencies globally at any time, these platforms offer unprecedented access and flexibility. Among the many options available, it’s essential to choose a reliable and efficient platform, such as online forex trading platforms Trading Platform BD, which can enhance your trading experience. In this article, we will delve into the key features of online forex trading platforms, the benefits they provide, and vital considerations for selecting the right one.

What are Online Forex Trading Platforms?

Online forex trading platforms are software applications that allow traders to buy and sell foreign currencies via the Internet. They connect to the foreign exchange market, enabling participants to trade various currency pairs with real-time pricing, analytics, and technical indicators. These platforms are crucial for executing trades efficiently and managing trading accounts.

Key Features of Forex Trading Platforms

When evaluating online forex trading platforms, several key features should be considered:

1. User Interface

The user interface (UI) is essential for ensuring a seamless trading experience. A well-designed platform should be intuitive and easy to navigate, making it simple for users to execute trades, view charts, and manage their accounts. Look for platforms with customizable layouts that cater to your individual trading style.

2. Charting Tools and Analysis

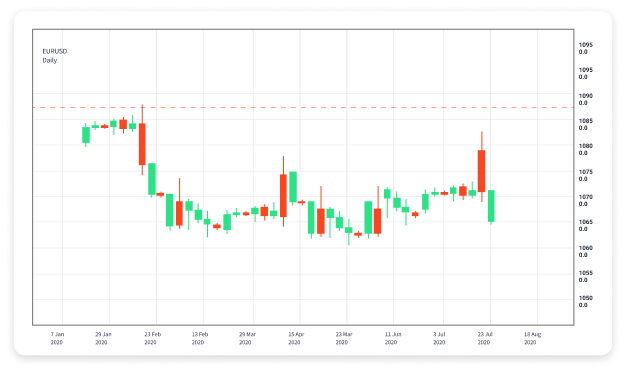

Robust charting tools are vital for conducting technical analysis. Platforms that offer a variety of technical indicators, drawing tools, and customizable chart types can enhance a trader’s ability to make informed decisions. The best platforms will also include news feeds and economic calendars to keep traders informed of market developments.

3. Range of Asset Classes

While forex trading is the primary focus, many platforms offer access to other asset classes, such as commodities, indices, and cryptocurrencies. A diverse range of instruments allows traders to explore different markets and create more comprehensive trading strategies.

4. Execution Speed and Reliability

High-frequency trading and instant execution are crucial in the fast-paced forex market. Look for platforms with a reputation for reliability and minimal downtime. Latency in trade execution can lead to missed opportunities, so it’s essential to choose a platform that ensures quick order processing.

5. Security and Regulation

Security is paramount in online trading. Ensure that the platform you choose is regulated by reputable financial authorities and employs robust security measures, such as encryption and two-factor authentication, to protect your personal and financial data.

Benefits of Using Online Forex Trading Platforms

The advantages of online forex trading platforms are numerous:

1. Accessibility

Online forex trading platforms allow traders to access markets from anywhere in the world, as long as they have an Internet connection. This flexibility is particularly beneficial for those who cannot be tied to a physical location or traditional trading hours.

2. Cost-Effectiveness

Many online forex brokers offer competitive spreads and low transaction fees, making it more cost-effective to trade compared to traditional brokerage services. This affordability encourages more traders to participate in the forex market.

3. Educational Resources

Many trading platforms provide educational resources, including tutorials, webinars, and market analysis. These resources can help traders of all experience levels improve their skills and understanding of the market.

4. Demo Accounts

Most reputable platforms offer demo accounts, allowing traders to practice without financial risk. This feature enables beginners to familiarize themselves with the trading environment and test their strategies before committing real capital.

Considerations for Choosing the Right Forex Trading Platform

Choosing the right online forex trading platform requires careful consideration of several factors:

1. Regulatory Compliance

Ensure that the platform is registered with recognized regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) or the Financial Conduct Authority (FCA). This compliance is crucial for ensuring your funds’ safety and the platform’s legitimacy.

2. Trading Fees

Forex trading platforms may charge different fees for various services, including trading spreads, commissions, and withdrawal fees. It is essential to understand these costs to avoid unexpected charges that could impact your profitability.

3. Customer Support

Responsive customer support is vital for timely assistance. Check if the platform provides multiple ways to reach customer service, including live chat, email, and phone support. Reliable support can be the difference between resolving an issue quickly or suffering losses.

4. Available Trading Tools

Look for platforms that offer advanced trading tools, such as algorithmic trading capabilities and mobile trading apps. These features can enhance your trading experience and improve your chances of success.

Conclusion

Online forex trading platforms have revolutionized how people engage with global financial markets. With various options available, traders now enjoy unprecedented accessibility, efficiency, and innovative tools to help them succeed. By considering factors like user interface, security, regulatory compliance, and available resources, you can choose the right platform to meet your trading needs. Whether you’re an experienced trader or just starting, the right online forex trading platform can make all the difference in your trading journey.