Forex Trading Beginner Guide

Forex trading can seem daunting at first, but with the right tools and understanding, anyone can succeed. This beginner’s guide is designed to walk you through the essentials of currency trading. To facilitate your trading journey, consider using a reliable tool such as the forex trading beginner guide Trading App APK.

What is Forex Trading?

Forex, or foreign exchange, involves trading one currency for another at an agreed price. This is done through a forex broker, who connects buyers and sellers on a global scale. The goal is simple: to make a profit by betting on the fluctuations in currency value. For example, if you buy a currency pair like EUR/USD, you are speculating that the Euro will strengthen against the US Dollar.

Understanding Currency Pairs

In forex trading, currencies are quoted in pairs, such as EUR/USD or GBP/JPY. The first currency is known as the «base currency,» and the second is the «quote currency.» When you see a price for a currency pair, it indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding how to read these pairs is critical for making informed trading decisions.

Major and Minor Currency Pairs

Currency pairs are categorized into major pairs, minor pairs, and exotic pairs. Major pairs include the most traded currencies globally, like the USD, EUR, and JPY. Minor pairs exclude the USD and consist of currencies like the NZD, AUD, and EUR. Exotic pairs combine a major currency with a more obscure currency, such as USD/THB (Thai Baht). Trading exotic pairs can be riskier due to lower liquidity and higher volatility.

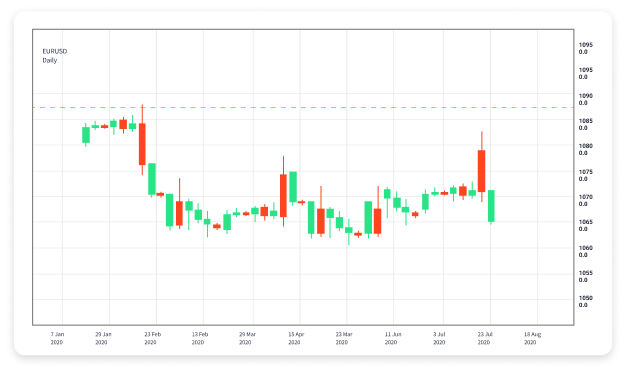

Understanding Forex Charts

Forex trading relies heavily on graphical representations of price movements. Charts reflect market activity and allow traders to analyze trends. The three primary types of charts are line charts, bar charts, and candlestick charts. Learning how to interpret these charts will provide valuable insights into market behavior and help you make better trading decisions.

Technical vs. Fundamental Analysis

There are two main schools of thought when it comes to analyzing the forex market: technical analysis and fundamental analysis. Technical analysis involves studying charts and using indicators to predict future price movements. In contrast, fundamental analysis focuses on economic indicators, interest rates, and geopolitical events that might affect currency values. Successful traders often incorporate both analysis methods into their strategies.

Creating a Trading Strategy

Having a solid trading strategy is vital for success in forex trading. A good strategy will include your trading goals, risk management rules, and specific entry and exit points. Test your strategy through demo trading to refine your approach without risking real money. Remember, discipline and emotional control are key to sticking to your strategy.

Risk Management in Forex Trading

Forex trading involves risk, and managing that risk is crucial for long-term success. Use a risk-reward ratio to evaluate potential trades. Many traders recommend risking only a small percentage of your trading capital on any single trade, often no more than 1-2%. Additionally, consider setting stop-loss orders to limit potential losses.

Choosing a Forex Broker

Your choice of broker can significantly impact your trading experience. Look for a broker that offers a user-friendly platform, competitive spreads, and excellent customer support. Ensure the broker is regulated by a recognized authority, as this provides an added layer of protection. Read reviews and compare various brokers to find the best fit for your trading style.

Practice on a Demo Account

Before committing real money to forex trading, practice on a demo account. Most brokers offer demo accounts that simulate live trading conditions without actual financial risk. Use this opportunity to familiarize yourself with trading platforms, test your strategies, and gain confidence in your trading abilities.

Continuous Learning and Adaptation

The forex market is continually evolving, and staying informed about the latest trends, economic news, and market events is crucial. Engage in continuous learning, whether through online courses, webinars, or reading industry-related material. Adaptation is equally important; be willing to adjust your strategies based on market conditions and personal trading performance.

Conclusion

Forex trading can be a rewarding venture if approached with the right mindset and knowledge. By understanding the fundamentals, analyzing currency pairs, and developing a solid trading strategy, beginners can navigate the forex market more effectively. Remember to stay disciplined, manage risks wisely, and prioritize continuous learning to build your skills and achieve your trading goals.